Legacy and Planned Giving

Turning one act of generosity into lasting impact.

For more than 50 years, supporters like you have made it possible for SDPB to inform, inspire, and connect communities across South Dakota – in all 66 counties. Planned giving is one way many supporters choose to turn their decades of dedicated support into something lasting. It’s a way for you to build a legacy and put your values in motion long-term.

No matter your stage in life, it’s never too early or too late to plan for your future. By including Friends of SDPB in your legacy plans, you are ensuring that what has mattered to you will continue to impact others for generations.

Create Your Free Will

Creating a will is one of the most impactful ways to care for the people and causes you love. To make this process more accessible, we have partnered with FreeWill – an online tool that helps you create your will for free in as little as 20 minutes. You can use this resource on its own, or to document your wishes before finalizing your plans with an attorney.

Have you already included a planned gift in your will or trust? Please fill out this form to let us know. We would love to thank you for your generosity and welcome you to the SDPB Legacy Society.

Designate Beneficiaries

Do you have an IRA, 401(k), life insurance policy, donor-advised fund (DAF), or any other assets not included in your will? These are called non-probate assets, and you must designate your beneficiaries for them separately. Use this online tool to make your plans and designate Friends of SDPB as a beneficiary of one or more of these assets.

Put Your Values in Motion Long-Term

Unless otherwise specified by you, legacy gifts to Friends of SDPB are added to the endowment to ensure that the work you have cared about for so long remains strong for generations to come.

The endowment is invested strategically, and then annual distributions from the endowment support SDPB’s ongoing work across South Dakota. Endowment gifts can be made directly to Friends of SDPB or through any of our partner organizations:

- Black Hills Area Community Foundation

- Sioux Falls Area Community Foundation

- South Dakota Community Foundation

- Watertown Area Community Foundation

We Are Here To Help

Contact any of the staff below with questions

IRS Tax ID/EIN

The IRS recognizes Friends of SDPB as a Tax-Deductible, 501(c)3 Non-Profit Organization.

Our Tax Identification Number (EIN):

23-7310698

SDPB Legacy Society

The Legacy Society is a community of visionary supporters who have chosen to invest in SDPB’s future with a planned gift or a current gift to the endowment. Members are recognized, honored, and celebrated not for the size of their gift, but for their commitment to SDPB’s mission.

Legacy Society Members Receive:

- Invitations to our annual Legacy Society celebration

- Artisan-crafted sculpture Generations, by SD artist Cameron Stalheim

- Invitations to special events, screenings, studio tours, and other SDPB opportunities

How to Leave Your Mark on this Vital Community Resource

A bequest to the Friends of SDPB will qualify your estate for a charitable deduction equal to the entire amount you bequeath.

Bequest

A will or trust is the simplest way to distribute your estate and is an easy way to designate gifts. Name SDPB as a recipient of a specific gift amount or percentage of your estate.

Beneficiary Designation

Name SDPB the beneficiary (or partial beneficiary) of your IRA, life insurance policy, CDs, bank account or any account that allows a beneficiary.

Charitable Remainder Trust

A charitable remainder trust allows you to keep the cash flow from the property contributed to the trust, and upon your death(s), the property that remains is distributed to Friends of SDPB.

Charitable Lead Trust

A charitable lead trust allows Friends of SDPB to receive cash flow, usually for a limited term of years.

Charitable Gift Annuity

A charitable gift annuity allows you to make a gift to Friends of SDPB and receive fixed payments for life on a schedule of your choice.

Other Ways To Give

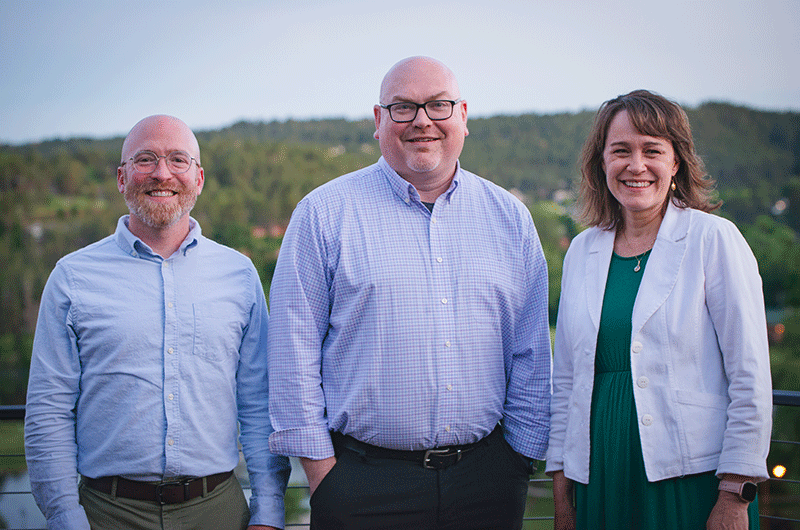

Meet Our Team

Val Simpson

Donor Relations Director (West)

Wade Gemar

Donor Relations Director (East)

Ryan Howlett

CEO, Friends of SDPB